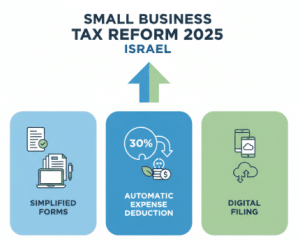

Israel Trapped Profits Law 2025 overview covering taxation of undistributed profits Section 81 wallet companies and residency tax rules

The Israel Trapped Profits Law 2025 is a pivotal reform in corporate taxation targeting undistributed profits especially in closely held and wallet companies This law imposes a 2 percent annual surtax on retained earnings aiming to promote profit distribution economic reinvestment and tax compliance The legislation also includes expanded rules in Section 81 regarding wallet companies with special conditions for new immigrants returning residents and foreign residents This comprehensive article provides insights on the law's scope implications and practical compliance strategies

Israel’s Trapped Profits Law 2025: Comprehensive Guide with Residency Rules and Regulatory Insights

The Trapped Profits Law, effective since January 1, 2025, introduces a transformative regime for taxing undistributed profits retained chiefly within closely held and wallet companies in Israel. This law enforces a 2% annual surtax intended to encourage the distribution or reinvestment of retained earnings to help stimulate economic activity and improve tax equity. Notably, it expands on Section 81 regulations covering wallet companies, while also providing special considerations regarding residency status relevant to new immigrants, returning residents, and foreign residents. This article offers a detailed explanation of the law, its broad implications, and practical guidance for compliance.

What Are Trapped Profits?

Trapped profits are earnings recorded on a company’s books but held back from being paid out as dividends to shareholders. Historically, companies paid the standard corporate tax rate of 23% on their profits, but shareholders could indefinitely defer personal income tax arising from dividends by leaving profits within the company. Under the 2025 law, an annual 2% surtax imposes a cost on accumulating undistributed profits, seeking to reduce tax deferral abuses.

Who Must Comply? Scope of Application

- Closely Held Companies: Defined as companies with five or fewer shareholders; often family or closely controlled business entities.

- Wallet Companies (Section 81): Passive investment holding companies now more explicitly targeted by law through an expanded scope and enforcement.

- Personal Service Companies: Companies with high profit margins engaging in service provision face additional marginal tax rates.

Residency Considerations: New Immigrants, Returning Residents, and Foreign Residents

An essential aspect of the law involves residency-specific tax implications. Israeli tax residency determines whether trapped profits within a company are subject to surtaxes and dividend taxation.

- New Immigrants (Olim) and Returning Residents: Under special tax agreements (such as the "Preferred Enterprise" program), new immigrants and returning residents may benefit from gradual tax exemptions on dividends and trapped profits for a limited period, often 10 years. However, they are subject to strict reporting and compliance norms under the new law.

- Foreign Residents: Shareholders not resident in Israel face different tax rules. Typically, dividends paid to non-residents may incur withholding tax, but tax on trapped profits is generally aligned with corporate tax rules, possibly exempting some foreign entities depending on bilateral tax treaties.

Key Provisions of the Law

- 2% Annual Surtax: Levied on undistributed trapped profits unless the company distributes a minimum percentage of dividends (5% in 2025, with increases over time).

- Dividend Distribution Mechanism: Companies can mitigate surtax exposure by distributing earnings at prescribed minimum rates.

- Section 81 Expansion: The law broadens the definition of wallet companies to encompass a wider array of passive income earners and tightens regulatory scrutiny.

- High Marginal Taxes on Personal Services: Tax rates up to 50% may apply to profits exceeding 25% of revenues in personal service companies.

- Stringent Reporting and Transparency Requirements: Firms must maintain detailed records and provide clear tax filings to comply with new obligations.

The 2025 Temporary Order: Dissolution and Asset Transfer Incentives

A unique feature of the 2025 legal framework is a temporary order allowing companies to voluntarily dissolve or transfer assets before the end of 2025 with significant tax benefits. These incentives include tax exemption on:

- Corporate tax on asset transfers during dissolution.

- Purchase tax relief and capital gains tax reduction on real estate transfers to shareholders.

- Two structured options: full company dissolution or partial asset transfer without full company closure, each conferring specific tax advantages.

To qualify, the dissolution/transfer processes must begin and conclude within specified time frames in 2025.

Frequently Asked Questions (FAQs)

What triggers the 2% surtax on trapped profits?

The surtax applies if companies retain earnings above prescribed thresholds at year-end without meeting mandated dividend distributions.

How can corporations avoid the surtax?

By distributing dividends representing at least a minimum percentage of trapped profits (5% for 2025, increasing over subsequent years), companies can avoid or reduce surtax liability.

What counts as a wallet company under Section 81?

Wallet companies are entities chiefly used for holding passive investments with limited active business activity. The law expands this classification to close tax avoidance opportunities.

What tax relief does the 2025 temporary order provide?

The order grants exemptions on taxes related to company dissolutions and asset transfers executed within calendar year 2025, encouraging efficient restructuring while minimizing tax consequences.

Are new immigrants or returning residents affected differently?

Yes, while eligible for temporary tax exemptions under Israeli tax incentives, new immigrants and returning residents must comply with the trapped profits law’s provisions and reporting duties to maintain benefits.

What should companies do to comply effectively?

Companies should:

- Review and verify undistributed earnings.

- Plan dividend distributions strategically to minimize surtax impact.

- Maintain accurate and transparent tax records and disclosures.

- Consult qualified tax professionals knowledgeable in the law, residency nuances, and temporary order specifics.

Practical Examples

- If a closely held company accrues $2 million in trapped profits, it can incur a surtax of $40,000 unless it distributes dividends of at least $100,000 in 2025.

- A wallet company with predominantly passive income faces stricter tax enforcement and must ensure compliance with Section 81's expanded rules.

- New immigrants taking advantage of tax exemptions must carefully track earnings and adhere to distribution rules to avoid losing benefits.

- Companies choosing to dissolve voluntarily in 2025 could benefit from tax relief on asset transfers under the temporary order.

Conclusion

Israel’s Trapped Profits Law represents a comprehensive reform designed to close existing tax loopholes concerning retained earnings and passive income entities. The law’s multifaceted approach—including Section 81 amendments and the 2025 temporary order—demands proactive attention from companies and shareholders, particularly regarding residency status and restructuring plans. Early planning and professional consultation are essential to maximize benefits and ensure full compliance.

For further information and professional guidance, read our full article at CPA Dray’s Trapped Profits Law Overview.

You can also review the official law text here: Israeli Trapped Profits Law PDF.